In a significant move for the cryptocurrency market, the Securities and Exchange Commission (SEC) gave the green light on Wednesday to spot bitcoin exchange-traded funds (ETFs) for trading in the United States. The long-awaited approval, involving 11 bitcoin ETF applications from various issuers including Fidelity, BlackRock, and VanEck, marks a pivotal moment in the evolving landscape of digital asset investment.

The SEC, opting for an accelerated approval process, announced that trading in these ETFs would commence on Thursday. However, the market witnessed a minor dip of approximately 1% in the price of bitcoin, settling at $45,620, immediately following the regulatory approval.

Among the approved bitcoin ETFs was Grayscale’s application, a development the company confirmed in a statement to TheBlock. Grayscale’s successful legal battle against the SEC played a crucial role in initiating the approval process for spot bitcoin ETFs, culminating in the SEC’s decision on Wednesday.

SEC Chair Gary Gensler, while expressing skepticism about bitcoin, emphasized the speculative and volatile nature of the asset. He stated, “While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

Spot bitcoin ETFs differ from their futures counterparts, as they hold actual bitcoin as the underlying asset of the fund. This contrasts with bitcoin futures ETFs, which have already received approval and involve contracts tied to the cryptocurrency.

Market analysts anticipate that the introduction of spot bitcoin ETFs will drive increased demand for bitcoin. The ease of access provided by these ETFs allows investors and financial advisors to allocate funds to cryptocurrency without the complexities associated with direct ownership, storage, and dealings with crypto custodians. By incorporating bitcoin into established brokerage accounts, a broader range of investors can seamlessly gain exposure to the cryptocurrency.

The involvement of major Wall Street players in issuing bitcoin ETFs is expected to enhance the credibility of the asset class among traditional investors. This influx of institutional interest could contribute to a surge in bitcoin’s price, with some predictions suggesting a potential increase to $200,000 by the end of 2025. Standard Chartered, for instance, estimates that inflows into bitcoin ETFs could range between $50 billion and $100 billion in their first year of trading.

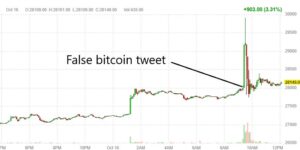

The approval of spot bitcoin ETFs follows an incident on Tuesday where the SEC’s social media account was compromised, leading to an unauthorized post claiming the approval of bitcoin ETFs. Chairman Gensler promptly clarified the situation through a rebuttal, confirming that the ETFs had not yet received approval.

As the cryptocurrency market continues to evolve, the introduction of spot bitcoin ETFs represents a notable milestone, providing investors with a more accessible avenue to engage with digital assets. The impact of this development on the broader financial landscape remains to be seen, but it undoubtedly marks a significant stride toward mainstream acceptance of cryptocurrencies.

Category: Cryptocurrency & Blockchain

Focus Keyword for SEO: Spot Bitcoin ETFs, SEC Approval, Cryptocurrency Investment, Bitcoin Price Outlook