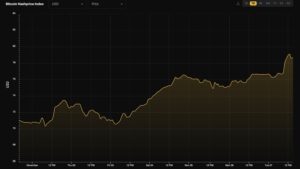

Bitcoin ETF Approval Update: Cryptocurrency enthusiasts experienced a whirlwind of excitement on Monday as Bitcoin briefly soared by 10%, fueled by a false report suggesting that the Securities and Exchange Commission (SEC) had granted approval for BlackRock’s spot Bitcoin ETF. The news, initially shared by CoinTelegraph in a now-deleted tweet, sent shockwaves through the market, with Bitcoin reaching a high of $29,900.

However, the euphoria was short-lived, as BlackRock promptly clarified to Bloomberg that the information was inaccurate. Contrary to the initial report, BlackRock’s spot Bitcoin ETF is still under review by the SEC, dispelling the momentary surge in Bitcoin’s price. This incident underscores the intense anticipation among crypto investors for the elusive approval of a spot Bitcoin ETF.

The volatile nature of Bitcoin’s price movements mirrors the enduring hope within the cryptocurrency community for the SEC to greenlight a spot Bitcoin ETF. While the regulatory body has approved Bitcoin futures ETFs, it has consistently rejected and delayed applications for spot Bitcoin ETFs over the past several years. The recent false alarm only adds to the rollercoaster of expectations surrounding this regulatory milestone.

Despite previous setbacks, optimism has been rekindled as major asset management firms, including BlackRock and Fidelity, have entered the arena with their own Bitcoin ETF applications. The involvement of these industry giants has brought renewed hope for the approval of a spot Bitcoin ETF. Additionally, a court decision favoring Grayscale Investments in its appeal against the SEC’s rejection of its Bitcoin trust fund conversion into a spot Bitcoin ETF has injected further optimism into the market.

The recent court ruling, coupled with reports suggesting that the SEC would not contest the decision, has heightened expectations for the imminent approval of a spot Bitcoin ETF. Influential figures in the crypto space, such as Ark Invest’s Cathie Wood, believe that the SEC’s stance is evolving. Wood expressed confidence in a recent interview, stating, “I do think the SEC is moving now… some of the research that we believe is percolating up to [regulatory] commissioners might be getting through to them and might be the grounds now for the approval of a bitcoin ETF.”

Wood went on to suggest that the SEC may not stop at approving just one Bitcoin ETF but could greenlight a group of them. This potential shift in regulatory sentiment has brought a sense of anticipation and optimism, even as more than 10 spot Bitcoin ETF applications remain under the SEC’s review.

In conclusion, the recent surge and subsequent correction in Bitcoin’s price following the false report on BlackRock’s spot Bitcoin ETF approval highlights the fervent desire within the cryptocurrency community for regulatory acceptance. As the SEC continues to navigate the complexities of digital asset regulations, the quest for a spot Bitcoin ETF remains a defining narrative in the ever-evolving landscape of cryptocurrency. Investors are left to ponder the potential impact of regulatory decisions on the future trajectory of Bitcoin and the broader crypto market.